Over the past week, VSP and the AOA have taken their differences over inclusion in Obamacare out of the conference room and into to the boxing ring. The public action appears to have started when former VSP Chairman, Daniel Mannen, wrote in VSP’s newsletter describing how VSP is optometry’s salvation…to paraphrase, “without VSP and Vision Plans…you’d be nutin.”

Over the past week, VSP and the AOA have taken their differences over inclusion in Obamacare out of the conference room and into to the boxing ring. The public action appears to have started when former VSP Chairman, Daniel Mannen, wrote in VSP’s newsletter describing how VSP is optometry’s salvation…to paraphrase, “without VSP and Vision Plans…you’d be nutin.”

AOA President (and Cleinman Performance Network’ Alumna) Dori Carlson struck back with a letter to members on the issue:

In addition, Dr. Carlson recorded a video message expressing the AOA’s position on the matter.

The AOA is spot on and deserving of support. But, in my opinion, there’s more to this.

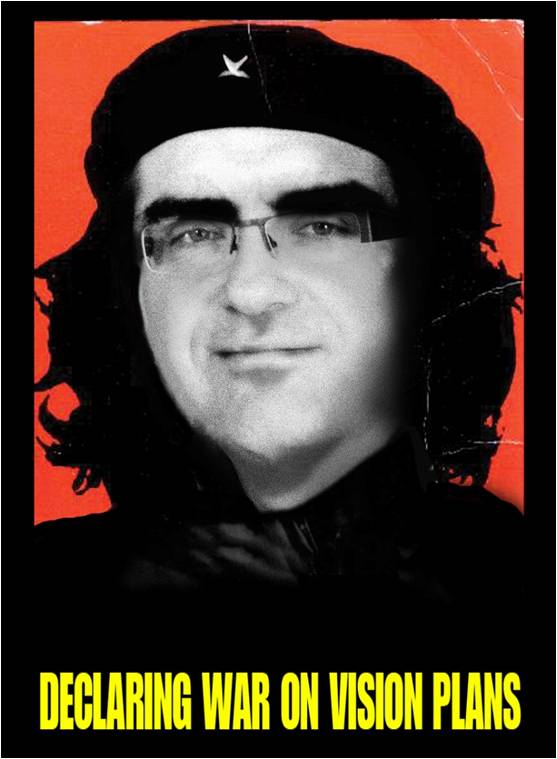

For the past 40 years, I have been a student of the eyecare industry. For much of my tenure in this wonderful business, I have been a vocal advocate for private practice optometry. For those of you who have read my blog over the past several years, it’s likely no surprise that last year, before my clients, I declared “war” on vision plans. The question is “why?”

First, let me repeat a comment that I’ve made in the past. VSP’s business model is pure genius. How can you fault an organization that, overtly or covertly, successfully convinced +/-28,000 optometrists that they can’t live without them; that their inclusion in VSP (and other vision plans) is their key to success; that patients won’t come to them otherwise. Then, armed with the resultant massive provider network, they’ve successfully convinced employers of over 50 million of our nation’s citizens that they should include scheduled vision plans in their benefit packages. Oh, and the result has been hundreds of millions in profits for VSP.

Yes, pure genius!

Unfortunately, as I’ve consistently expressed, Vision Plans, like other forms of wholesale discounting (BOGOS), have destroyed our industry’s “brand.” Further, the existence of these plans and their fear based promotion to optometry has done little to grow our industry. Indeed, were it not for the existance of these unnecessary discount programs, there would be no fight as to where vision care belongs in the new healthcare environment.

At Cleinman Performance Partners, we study gobs and gobs of data submitted by our clients. As the world’s leading business development consultancy for larger optometry practices, we maintain the largest database of optometry performance data on the planet. We’ve been doing so for over twenty years. What does our data tell us?

In a nutshell, it tells us that practices that focus their attention on building the very best local brand possible succeed magnificently without vision plans. It’s that simple. Why? The truth is that private optometry has largely abdicated its marketing to the likes of VSP. Yes, VSP puts butts in seats. But patients delivered by discounting, like customers delivered by discounting, have a hard time bridging the value quotient when that value quotient isn’t properly communicated. All they know is “discount.” As a result, most practice leaders have simply not invested in what’s necessary to effectively communicate the value quotient of their practice nor have they separated their practice from the competitive pack. The average optometrist sees the unit volume delivered by vision plans as a panacea. A deeper business understanding clearly proves that vision plans have questionable economic impact on the very providers upon whom they depend. While VSP beats their drum about all that they do for private optometry, it’s clear that they seek but one thing…profits to line their pockets.

So, my message for this Thanksgiving is that private optometry should be thankful for the AOA and thankful that the truth about vision plans is finally emerging.

In a perfect world(practice), it would be my desire to not accept any insurance at all. The majority of the public doesn’t realize that filing insurance claims for reimbursement is ultimately the patient’s responsibility, but we, as providers, have elected to assume that role as a benefit to our patients. The nightmares that creates trying to get them to understand what their benefits cover and don’t cover could fill a Steven King multi-novel saga…Another case of insurance companies wanting the provider to do their job of communicating benefits. Unfortunately, for our practice, as you mentioned previously and I would imagine with many others’, businesses within our area are promoted insurance coverage that includes VSP as a “bonus” and rarely costs the employer or employee anything extra. That being said, it is very hard to turn our backs on what represents over $200,000.00 of annual income. It would be nice to come to work and provide good quality care and products to patients that actually show up for appointments and pay for them when rendered, but how do we get from where we are to where we want to be without staff layoffs and salary cuts in the mean time?

Chris,

Thanks for your comment. I fully understand the dilemma and would enjoy discussing your specific situation with you. One place to start is with establishing “value.” I provide two suggestions…in rough draft form:

a) Include a new item on each receipt that you provide to an insurance patient: “Insurance Benefit Verification and Claim Processing – $50.” Then, on the same invoice, provide “Insurance Charge Courtesy Credit” and reverse the charge. This establishes the value of the service. You may get some questions…which is an opportunity to communicate with the patient about the true costs associated with insurance plans and the wonderful service that you provide as a courtesy.

b) To reduce no-shows, provide an appointment confirmation both at the time the appointment is made but also via e-mail or text message (consider using SolutionsReach…Smile Reminders) the day before the appointment. The messaging should clearly establishe the value of your time. At your request, we have committed Dr. Ratcliff’s and our support staff’s time for your appointment on _____ at _____. If you cannot keep this appointment for any reason, please extend the courtesy of a 24 hour notice by calling our scheduling desk at ________. This allows us to refill the appointment from our waiting list. If you fail to provide proper notice of your cancellation, there will be a $___ cancellation fee. Thank you for understanding the importance of our mutual committment.”

Best of luck and I look forward to meeting you soon.

All of wish we could roll back time 30-40yrs and not have to deal with managed care, but that’s not possible and given today’s market, wouldn’t help. Consumers forced to pay out of pocket would be looking for deals even more than they already do. Each of us needs to look inside and remember that the next time we use any kind of coupon code or discount voucher. Ironically, vouchers are a key example. How many of my colleagues will gladly try the latest lens or frame, but only if they get a voucher for it.

What the public needs to better realize is the difference between Vision Insurance and Medical Insurance. Vision and Dental plans are basically allowances for the employee. They pay a very small amount per month pre-tax to realize the savings when needed. “Congratulations Mr. Smith, your vision plan covers XXX amount of today’s visit and XXX amount towards your lenses and frames. Now you can more easily afford the better quality lenses and the frames you really want. ” Set the tone right and patients look at it differently. My people don’t struggle at all to make money and up-sell insurance plan patients into products that are better for everyone. Just explain what their benefits really are, an allowance/discount they pay for monthly to insure they can more easily afford the products and services they need and are coming to you for.

Plan wise, as a panel provider, I’m unclear as to why you resist the idea of having to explain to your patients how their benefits work? Do you not see that as a value to them? When I take my kids to the dentist, I value their approach in helping me maximize my dollars and understand the plan I have. You work with these plans everyday, patients don’t. Why would you not want to help them? As a panel Doctor you accepted the insurance plan guidelines and all that comes with it, including helping the patient inside and outside the exam lane. I’m sorry, I see that differently than you. There are no nightmares, if I need help with a VSP Plan, I just have my people call their support desk. Pretty simple and my patients appreciate it. Again, if you’re in a position where your managed care patients dominate those walking in your door, then I encourage you to help them vs blaming their managed care company or employer.